Best 7 Options For The Bad Credit Car Loans

A bad credit car loan is just like a normal car loan with accommodations to your credit. Companies provide these types of bad credit car loans at a higher interest rate than usual.

More than 500,000 bad credit auto financing companies were closely assessed to search through competitors for the best bad credit car loan rates for those having a FICO score of 619 or below.

Bad credit auto loans will be provided by numerous banks, online moneylenders, car dealerships, credit unions, and thrift institutions.

It is advisable to do complete market research and compare multiple alternatives from top corporations before settling for an offer.

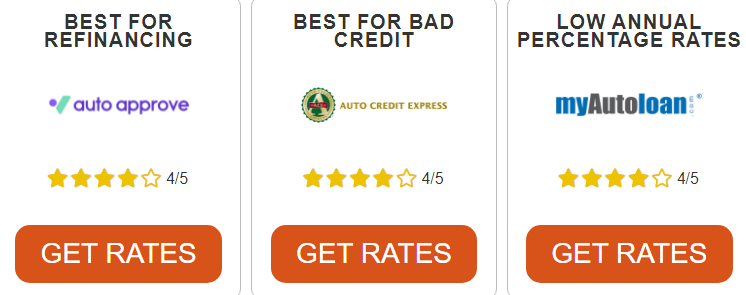

Following are a few companies that suggest great ways to get going with your process online within a couple of minutes.

7 Best Car Loans for Bad Credit

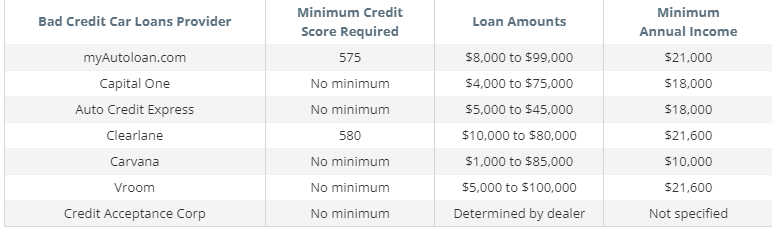

Following are seven well-reputed automobile companies that offer bad credit car loans, with a few having minimum or no FICO credit score demands. Regardless of credit scores, the majority of the companies deem it necessary to have supporting documentation of a stable annual income.

1. MyAutoloan.com

MyAutoloan.com, an interest-based corporation founded in 2003, is an online money lending platform that deals in bad credit auto loans.

In this online marketplace, a minimum FICO score of 575 and a yearly $21,000 income is required to be allowed auto financing. MyAutoloan.com is a good choice due to the following additional reasons:

• Prompt service:

Customers receive up to 4 customized offers within a couple of minutes.

• Purchasing instruments:

A chart with the lowest interest rates for each category is provided on the website, along with an interest rate estimator and a calculator so that you get a better picture of your financial status.

• Good customer reviews:

Out of 700 customer testimonials, myAutoloan.com has a 4.3 rating out of 5 on Trustpilot. This factor distinguishes the online loan provider from its competitors.

Where complaints and bad reviews are concerned, myAutoloan.com has only received ten complaints via the Better Business Bureau in the previous three years.

2. Capital One Auto Finance

Unlike other banks, Capital One’s auto financing does not require cardholders to have a high credit score or a minimum score.

The only condition to be eligible to apply for Capital One Auto Financing is to be 18 years old and have an annual income ranging from $18,000 – $21,600.

Here’s why it is recommended to borrow bad credit auto loans from Capital One:

Does not affect your credit score:

A soft inquiry conducted by the company when acquiring your credit information does not in any way affect your credit score.

• Time to explore options: The offer placed after the basic review has been made stands for 30 days which gives individuals time to look around at other competitor dealerships and their offers.

• Choice of the dealership: You can use Capital One’s Auto Navigator® to search for vehicles at over 12,000 participating dealerships, making the car-buying process easier.

3. Auto Credit Express

Founded in 1999, Auto Credit Express is one of the leading online bad credit auto financing platforms which has catered to millions of clients since its establishment.

There is no credit score requirement to obtain a loan, and the amounts vary from $5,000 – $45,000.

Following are a few more highlights:

• High customer rating: The auto financing company is rated 4.7 by customers on Trustpilot and has an A+ rating licensed by Better Business Bureau.

• Advantageous in the course of or after bankruptcy: Auto Credit Express deals in loans after an individual is declared bankrupt.

• Asset for shoppers: A variety of options are provided by Auto Credit Express on their online platforms, such as credit reports, auto insurance, refinancing, and tools such as a loan estimator and payment calculator.

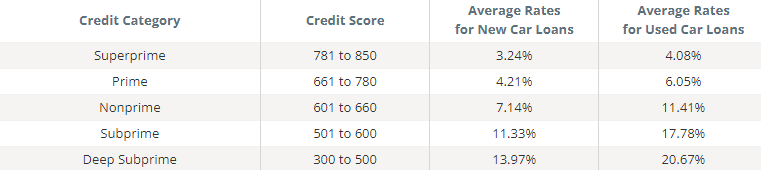

Average Rates for Bad Credit Car Loans

In accordance with Experian’s 2020 State of the Auto Finance market research, the following are the average market rates for the latest and second-hand automobile loans.

As is evident, your credit score plays an integral role in interest rates. A poor credit score will mean to the lender that the borrower is unlikely to make timely payments. A higher interest rate is charged in such cases to counterbalance the probability of not being paid on time or at all.

The five categories based on credit score are stated in the chart below:

We can observe the average interest rate rising with each category, but the steep jump is from nonprime to the subprime category.

Note that the loan’s payment plan does not only change with the interest rate but also with factors such as extended car warranty, which would be included in your loan price.

Increase Your Credit Before Buying a Car

Many of your money can be saved if you increase your credit score. See how credit scores affect interest rates:

Suppose you purchase a brand new car after receiving a $15,000 loan for 60 months. You would have to pay:

• $298 monthly ($2,881 in total interest) for a nonprime score.

• $329 monthly ($4,717 in real interest) for a subprime score.

• $349 monthly ($5,927 in real interest) for a deep subprime score.

It can be seen that the interest rate increases drastically by just a few hundred points on the credit score.

Keep the following in mind to raise your credit score:

• Ensure timely payments are paid.

• Pay off small debts first.

• Increase your current credit limit and use 30% or less of your available credit.

• Be wary of hard inquiries on your credit report.

• Try making monthly payments with lower interest rates for debts.

• Analyze your credit report and check for any errors to sort out.

• Apply for a personal loan. Qualifying for a personal loan may be an easier option for you, varying on your credit score. However, the interest rates for personal loans may be more.

• Get a family member or close friend to cosign on your loan. Their income and credit situation will be taken into consideration by the lender and, in turn, secure a lower interest rate. Accidentally skipping a payment would affect both your and the cosigner’s credit score.

Compare Bad Credit Car Loans from Top Dealership

It is advised to compare several lenders and their terms of loans to find the most suitable financing for car loans with bad credit.

A lot can cut down car dealership costs by buying from private sellers instead.

In this day and age, you no longer have to go around to banks, credit unions, and dealerships because finding the best fit for your needs is just a few clicks away. Several companies around the world now have online loan pre-qualification offers.