Best Second Chance Bank Accounts to Look Out for in 2023

Customers with a questionable financial past might benefit from second chance bank accounts, which provide convenient and accessible banking services. Bounced checks and unpaid overdrafts might make opening a bank account difficult, but some institutions will still let you create a checking account with which you can write and deposit checks, use a debit card, and pay bills online.

Some banks will refuse to create an account if you have a suspicious financial history in specific conditions. However, if you’re attempting to achieve economic sustainability, opening a checking account can help you save money on check-cashing and other absurd banking costs. A second-chance checking account may well be the best solution in these cases.

Here’s everything that you need to know about second-chance bank accounts.

Table of Contents

What is Second Chance Bank Accounts?

You could still be eligible for second-chance accounts, even when you couldn’t get clear for a checking account.

Although you must pay a monthly charge to keep one of these accounts active, you may be able to waive the fee if you satisfy specific conditions. You might be able to upgrade to a fee-free checking account with the same bank over time (or another one). Second-chance bank accounts are so named because they allow clients to open a bank account after being refused by a large bank.

Customers who have been turned down for standard bank accounts now have the option to earn their way back into the bank’s good graces with a second chance bank account. ChexSystems, a financial services corporation, keeps records of customers’ banking history, similar to credit agencies. Bounced checks, overdrawn accounts, and incidents of fraud may all land up on your ChexSystems record, and banks may refuse your application to create a new account if you have enough black marks on your record.

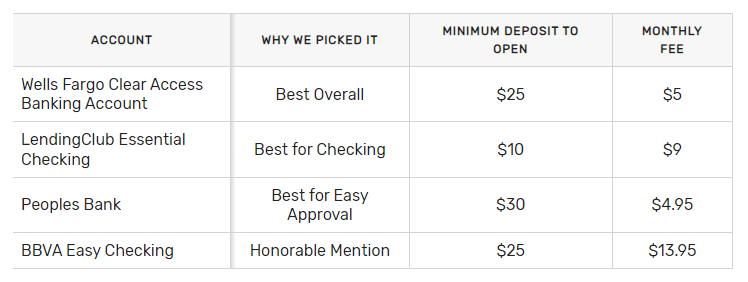

Best Second-Chance Bank Accounts

We’ve selected a few of the greatest choices. Your ChexSystems past and other concerns will not necessarily preclude you from creating an account with the second-chance accounts listed below. We also highlighted banks with low costs and the experience you need for simple day-to-day banking.

Best Overall: Wells Fargo Clear Access Banking Account

Best for Checking — LendingClub Essential Checking

Best for Easy Approval — Peoples Bank

Honorable Mention — BBVA Easy Checking

1. Wells Fargo Clear Access Banking Account

If you want a classic brick-and-mortar bank, Wells Fargo is a good option. The Clear Access banking account from Wells Fargo includes a debit card, online bill pay, and more. However, there seem to be no paper checks available, and you can’t transfer money to friends and family using your checking account. A $5 monthly fee is charged for this account, however, it is waived for consumers aged 13 to 24. To start a Clear Access Banking Account, you’ll need at least $25. Wells Fargo has a significant branch network with 4,900 locations and over 12,000 ATMs.

It has the following features:

- Customers between the ages of 13 and 24 are admitted for free.

- There are several branch sites.

- There are no fines for overdrafts or insufficient money.

2. LendingClub Essential Checking

With the Essential Checking account, LendingClub ticks all the boxes for payment alternatives. Checks, debit cards, online bill payments, and person-to-person payments are all options. Customers can also use one of 20,000 surcharge-free ATMs. If all goes well, you can request that your account be converted to a Rewards Checking account with increased features and no monthly cost after one year.

Until then, however, the account is subject to fees and restrictions. You’ll be charged a $9 monthly fee with no exceptions, and you’ll need to deposit at least $10 to start an account. In addition, LendingClub restricts debit card transactions to $500 per day ($250 for the first 30 days).

It allows you to pay bills via cheques, debit cards, and online bill pay.

Upgrading to a regular account is a possibility.

3. Peoples Bank — BEST FOR EASY APPROVAL

The Peoples Bank Second Chance Checking account is open to nearly anybody with a smudge on their checking history—as long as they haven’t engaged in any fraudulent behavior. The account comes with check writing, a debit card, online bill pay, and more for a monthly charge of $4.95. Peoples Bank’s two locations in Paris, Texas, have a surcharge-free ATM network, therefore expect to pay $2 to Peoples if you use another bank’s ATM. You may also be required to pay an ATM charge. You’ll need to deposit $30 to start an account.

It comprises:

- a comprehensive variety of services

- Possibility of switching to a less priced account

- There are no exceptions to the $4.95 monthly cost.

- Surcharge-free ATM access is limited.

4. BBVA Easy Checking

Although the costs are on the high side, BBVA provides an Easy Checking account with a lot of options. You may use this account to write checks, get a $10 debit card, pay bills online, and more. There is a $13.95 monthly service fee with no exemptions, and you must pay BBVA $3 to use a non-BBVA ATM. An extra fee may be charged by the ATM’s owner. You can seek an upgrade to a BBVA checking account with no monthly fees and greater ATM access after one year. To start an Easy Checking account, you’ll need $25.

It has the following characteristics:

- A whole variety of services are available.

- Possibility of switching to a less priced account

- There are no exceptions to the $13.95 monthly cost.

- Surcharge-free ATM access is limited.

Second-chance accounts allow you to create a bank account despite having somewhat less credit history, which may cause other institutions to reject your request. Standard banking features such as direct deposit, online bill pay, mobile deposit, and a debit card connected to your checking account are usually available with these accounts.

A bank account may be able to save you both time and money. You can have your employer send payments straight to your account if you have a second-chance bank account. Paychecks can also be deposited using your cell phone.

When you create a second-chance account, you’re paving the way for a more cost-effective banking relationship. After 12 months, BBVA and LendingClub, for example, both provide the option of upgrading to a conventional checking account. The first step is to get your foot in the door.

Some banks are hesitant to give consumers with little financial records a second opportunity, especially because it may expose them to costly risks. You might easily be locked out of contemporary banking if you have a history of failed checks or debit card overdrafts.

Banks, fortunately, enjoy generating money as well, and some provide special “second chance” accounts that reduce risk while enabling customers to continue in the banking system. A second chance bank account allows consumers with a blemished credit history a second chance to prove they can bank responsibly.