How To Check Your Credit Score In 5 Minutes

Do you know what your credit score is?

You’re not alone if you have no idea. According to a poll conducted by LendingTree, six out of ten Americans would be unable to tell you their credit score if asked.

The interesting thing is that checking your three-digit score, which serves as a grade for your financial life and is used when you apply for a credit card, mortgage, or vehicle loan, is now easier than ever.

Your credit score is a vital statistic that lenders use to determine your creditworthiness, from filling out a credit application to locking in the best mortgage rates. That’s why it’s important to maintain track of your credit score frequently, especially because it’s computed monthly and may be changed by things like establishing a new credit line or paying off debt. Your credit score has an impact on loan eligibility, lease restrictions, and your ability to get the best interest rates and Card offers.

There are two credit score scales: FICO and AdvantageScore. Both have somewhat different scoring ranges and may compute scores differently, emphasizing particular characteristics like credit history or credit use ratio more than the other. While the exact number may differ across providers, your credit score will most likely fall within a similar range for VantageScore and FICO.

A “soft check” is when you check your credit score without affecting your score or appearing on your credit report.

Checking your score will help you review your financial success, correct any errors that may be affecting your score, and establish financial objectives for the future.

It’s beneficial to be aware of your credit score. You’ll know what you’re likely to get accepted for, what interest rates to expect, and how many opportunities for improvement you have. Credit ratings vary from 300 to 850, with anything above 780 seen as excellent and anything below 600 regarded as fair to poor.

With that stated, it’s more necessary to monitor your credit reports, of which you have three, one from each of the major credit agencies, Experian, Equifax, and TransUnion. These reports contain all of the information that goes into your credit score, so it’s critical that you understand what’s on them and can attest to their authenticity.

You are entitled to a free copy of your credit report once a year under federal law. AnnualCreditReport.com is the only location where you can get them. Pull all three reports at once if you’ve never checked them before or it’s been a long time. If not, consider retrieving one report every four months.

Examine your reports for any errors as soon as you receive them. It’s unlikely that a slightly misspelled address or other tiny error would cause you any concern. However, be especially wary of unfamiliar items, such as accounts that don’t belong to you or late payments that you know you made on time.

Many believe that you’ll see credit scores if you look at your credit reports from the three major credit agencies. But this isn’t the case – credit scores aren’t normally included in credit reports from the three national credit agencies. Before we get into where you can acquire credit ratings, you should understand a few things about credit scores.

You need to know that you do not have only one credit score.

Credit scores are calculated to check your credit risk or the timely payments of your debts. Credit scores are determined using an algorithm based on the information in your credit reports.

Core providers like Equifax, Experian, and TransUnion and firms like FICO employ a variety of credit scoring algorithms and may use different sorts of information to compute credit scores. Because certain lenders may submit information to all three, two, or one, or none at all, credit scores are given by the three national credit bureaus will vary. Additionally, lenders and creditors may use information other than credit ratings to determine whether or not to extend credit to you.

So, how do you obtain your credit scores?

Here are a few ways:

Examine Your Credit Card, Loan Statement, or Bank Account

Many credit card firms, banks, and lending organizations have begun to provide clients with credit ratings. You may find it on your statement or go into your account online to find it.

Purchase Credit Scores Directly

Make sure to purchase credit scores directly from one of the three main credit agencies or a third-party supplier.

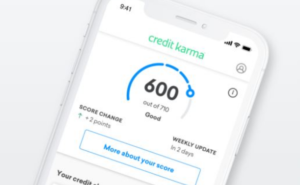

Use a Free Credit Score Site

Users may get a free credit score on several websites. Others may provide credit scores to consumers who pay a monthly membership fee for credit monitoring.

Check Your Credit Report

Equifax, Experian, and TransUnion are required to provide you with one free credit report each year. Due to the COVID-19 epidemic, you can view your report monthly until April 2021. To get a free copy of your credit report, go to AnnualCreditReport.com. Check out this post for step-by-step instructions on how to check your credit report.

Check Your Credit Score

In most cases, your credit score will not appear on your credit report, and the law does not require unfettered access to your credit score as it does to your credit report. However, there are numerous methods to get it. The majority of credit card providers will supply you with your FICO score. Examine your monthly bank statement or access your account over the internet. If you can’t locate it, contact your bank to inquire about your credit score and where to find it.

Regularly Monitor Your Credit Health

It’s critical to keep an eye on your credit health based on the information given in your credit report frequently. Early detection and correction of discrepancies or errors on your credit report can help you avoid being caught off guard by a sudden decrease in your credit score and identify possibilities for improvement. Take advantage of free credit reports and credit score access to keep track of your credit health.

It’s never a bad idea to monitor your credit reports promptly, in addition to reviewing your credit scores, to verify that the report is correct and accurate.

Contact the lender or creditor if you notice anything that you feel is incorrect or incomplete on your credit reports. You can also check in with the report with the credit bureau that issued it. To register a dispute with Equifax, you must first create your Equifax account.

If you find any problem with your credit score, correct them as soon as possible. Your credit score will appreciate it.

You probably lack sufficient credit history to generate a score. Perhaps it’s because you’ve avoided taking out student loans or haven’t applied for a credit card yet. As a result, building credit should be your first focus.