Does Credit Karma Hurt Your Score?

There are bundles of questions surfacing every day on the internet related to Credit Score queries. Each question has its following base. It determines how important credit score reports are for people. And today’s trending question can be, does credit Karma hurt your score.

We’ll discuss this later; for now, let us understand the basics first.

Likewise, you can see businesses and apps coming into existence that will send you emails or show ads on the web to check your credit score free of cost, and this brings up yet another question to life ‘if checking your credit score will hurt your score report?

Credit reports are really important for people. These reports help put a huge impact on the things they can buy from auto insurance to a mobile phone to a house to a car and lord knows what.

It is why people are always curious to know what their credit score is. They monitor it to keep it as high as possible to increase the chances of getting their loans approved smoothly.

The higher your score, the lower the interest rate and best possible terms and conditions you will get on your approved loan. A high scorer is considered as a low risk of fraud. But ‘can checking one’s credit score report too often send it down the hill?’ is the real question.

To understand the answer better, you first need to understand what ‘soft pull’ and ‘hard pull’ inquiries are.

Table of Contents

What Are Soft Pull and Hard Pull?

The two terms are kinds of inquiries lenders of companies run to check whether you are good at managing your finances or not when considering your loan approval. Let’s talk about soft pull first.

Soft Pull

A soft pull is a background check on your credit either by a person or a company. These inquiries also go by’ soft pull Inquiry’ and ‘soft credit checks.’ These background checks can be done by an employer or the one who issues a credit card, so see how potent you are for the respective approval.

Soft pulls do not put any impact on your credit scores. The checking might or might not be recorded in any of your credit score reports depending on what agency it is. These inquiries are just connected with specific loan applications you applied for; they are there only for you to monitor or view when you want to.

A few types of soft pulls you would love to know are;

- Checking Credit Score by yourself.

- Credit Card Offers Prequalification.

- Insurance Quotes Prequalification.

- Verification for Employment.

The soft inquiries would not hurt your score. However, hard inquiries can.

Hard Pull

Contrary to soft pulls, hard pulls are inquiries that are run by any financial organization like a lender or a bank to check your credit history while they can decide to lend you money. These hard pulls also go by different names as soft pulls, such as hard pull inquiries or hard credit checks.

A hard credit check usually occurs when you apply for a personal loan, business loan, mortgage, or credit card. You are generally required to authorize the financial institute of hard credit check.

Hard pulls leave a negative mark on your credit scores, unlike soft pulls. The inquiry reports can stay on credit scores for two years and easily lower your credit scores by a few points. However, there is a possibility that the damage from the hard inquiry may not even last the entire inquiry process.

You must not apply for too many credit cards in a month or two months. It will highlight you as a higher risk for the lenders and creditors.

The scores getting affected by these inquiries depend on the number of inquiries conducted in what period. One or two won’t have a major impact on the score. However, inquiries a lot more than two can severely damage your overall credit score.

A few types of soft pulls you would love to know are;

- Personal Loan.

- Credit Card issuance.

- Auto Loan.

- Mortgage.

Now that we are done explaining a few basics about checking and monitoring credit scores, let’s get back to your original question ‘does credit Karma hurt your score?’.

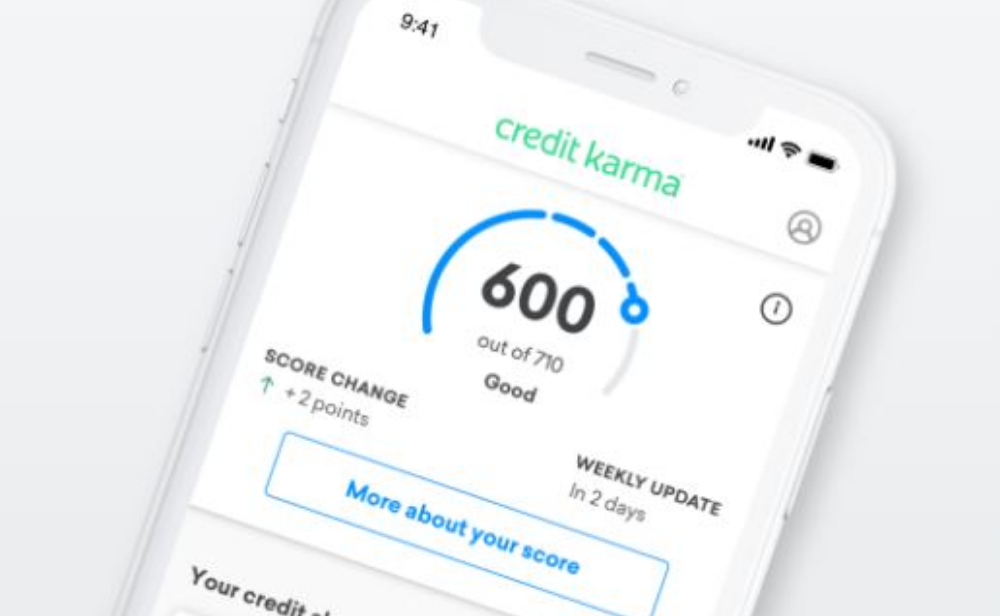

What is Credit Karma?

Credit Karma is a US-based multinational company for finances. It came to existence in 2007 and has achieved a status of a brand of Intuit since 2020. The company is known for its services as a free credit and financial management institution for millions of people.

However, the other features of the company include unclaimed property databases monitoring. It is also very famous for being a tool that identifies and debates over credit report errors. The company has expanded and started to operate in Canada and the UK.

Credit Karma is famous for its credit scores and credit reports. However, the company worked hard to make its position more broadly as a website. They offer the best possible solutions to their clients to get better opportunities for building a better financial future.

Credit Karma requires you to provide the company with your basic credentials, usually your name and your social security number (the final four digits). After getting your permission, Credit Karma accesses your credit reports credentials from TransUnion or Equifax, compiles a VantageScore, and sends it to you.

Does Credit Karma Hurt Your Score?

We would love to answer your question very straightforwardly, no. Credit Karma does not affect or lower your credit score on your credit report.

You can check your credit score for free on Credit Karma without hurting your credit. The kinds of credit check Credit karma processes are called soft inquiries. And we already have explained what soft inquiries are in detail earlier.

So when Credit Karma gets your credit score from any of the two major bureaus, TransUnion or Equifax, it requests the respective information on your behalf. The information is only called for your reference or monitoring rather than applying for a new line of credit.

Since Credit Karma is running a soft inquiry, it will not negatively impact your credit score.

Conclusion:

So we hope you get the answer to your question: does credit karma hurt your score? We have tried our best to explain all the details of how soft inquiries won’t hurt your score at all. People request these Credit Karma soft credit checks to get an idea of their score and how they want it to be. So they get to practice good credit habits or work on building them more.