What is Credit Freeze and How To Freeze Your Credit

A credit freeze or security freeze permits you to limit means of entry into sensitive data like your credit report to keep you protected from fraudulent activities and credit applications.

With a security freeze, you have full authority over your financial data as your credit score and other elaborate credit reports by credit bureaus are stopped from being published. It should be noted that freezing your credit does not affect the credit score and it’s free of charge.

Potential lenders will not be able to view your report. This, in turn, prevents frauds and identity thieves from opening new credit accounts (LOC – line of credit) using your personal data such as name and social security number.

TransUnion, Equifax, and Experian are the three major credit bureaus in the U.S. who provide data to various consumer reporting agencies across the region.

Lending institutes such as auto dealerships, mortgage banks, credit card agencies, and other companies purchase access to your credit report to view and analyze your history to determine whether you are a defaulter or a good credit risk.

Hence, a credit freeze will protect your account against fraudulent activities such as imposters extracting debts using your name for a housing loan for instance.

Place a credit freeze if you’ve been a victim of a data breach

To prevent identity thieves from opening new lines of credit in your name during a data breach, consider placing a credit security freeze as your credit file will become inaccessible for all creditors. As a result, they will not be able to provide loans to anyone applying for it using your personal information.

Bear in mind that freezing your credit will not prevent your current financial accounts, for which credit checks aren’t required, from being accessed.

What Is a Credit Lock?

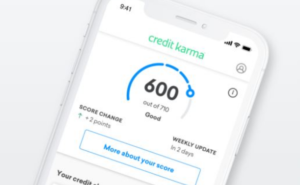

A credit lock is similar to credit freeze in a way that all access to your credit report is blocked. However, with credit lock, the feature can be enabled and disabled immediately using an app on your smartphone or via a registered website.

Credit lock is a simple and less complicated option as compared to credit freeze as there’s no 24 hour waiting period to lock your credit file, or an hour-long wait to unlock it. National credit bureaus offer different credit-locking services such as CreditLock offered by Experian as part of its CreditWorksSM Premium subscription facility and it includes:

- Obtaining credit reports from the three major credit bureaus each month.

- Recent credit activity alerts and notifications for your credit accounts at any of the bureaus. This is specifically to assist you in identifying any unwarranted action(s).

- Insurance worth up to $1 million for identity theft.

- Expert guidance from Experian representatives for credit and fraud.

You are required to give evidence of your identity to credit bureaus when you intend on setting up a credit lock. The needed documents can be submitted via email or by mailing the hard copies.

The benefits and limitations of locking your credit are the same as the ones for a credit freeze: No delinquent or any legit creditor can access your credit report even if you have applied for a loan.

The credit lock feature is relatively more convenient than credit freeze as you can secure and unlock your account without a delay, making the application procedure a simpler one.

Credit Freeze Guide

Contact the three major credit bureaus via their websites when you need to place a credit freeze on your credit files:

- Equifax.com (1-800-349-9660)

- Experian.com (1-888-397-3742)

- Transunion.com (1-800-680-7289)

The following information will be required of you:

- Name

- Address

- Date of birth

- Social security digits

- Other personal details

You will be given a personal identification number after you apply for a credit freeze. This security code will allow you to lock and unlock credit files at your will when access needs to be given to creditors.

With a credit freeze, the following steps can be taken free of cost:

- To add a credit freeze simply means freezing your credit files.

- Lifting the credit freeze will eliminate the freeze for the time being so that new credit can be applied for, or for creditors to be able to view and analyze your report.

- Removal of a credit freeze will remove the freeze for good.

When Will You Need To Lift a Credit Freeze?

A credit freeze will need to be lifted on various occasions for instance, when you plan on purchasing or renting a car or house, signing up for cell phone services, and applying for a new credit card. Most companies also carry out a credit check before employment.

You may appeal to lift a credit freeze for a particular company for a certain period of time. According to the Federal Trade Commission, credit bureaus are compelled to lift a credit freeze within an hour of the online request. If the lift has been requested via mail, the credit reporting agencies have three business days to temporarily remove the freeze.

It should be noted that current creditors and government agencies, under some conditions, have access to credit reports despite a freeze. The situations may vary from court/administrative orders to a search warrant or a subpoena.

There are several options apart from freezing your credit for protection against fraud or identity theft. You may want to monitor your credit report regularly to check for any strange or doubtful transactions.

AnnualCreditReport.com provides you an annual copy of your credit report from three credit bureaus for free. Your credit reports are accessible to you despite having placed a credit freeze.

Will A Credit Freeze Damage Your Credit Score?

Along with not affecting your score in any way, a credit freeze, as per FTC, additionally does not follow these practices:

- Create hindrances to acquiring your yearly credit report.

- Hold you back from activating new lines of credit.

- Stop you from buying or renting a house, employment, or purchasing insurance.

As per the Federal Trade Commission, a temporary lift of the freeze may be required for any of the above-mentioned actions. Monitor and keep a check on all your financial accounts at regular intervals to prevent identity theft and additional charges to your accounts.

Pros and Cons Of A Credit Freeze

A credit freeze is useful and advisable for when you fall victim to identity theft, or if your social security pin has been revealed.

Examine the following pros and cons before applying for a credit freeze.

Credit Freeze Advantages

Listed below are some benefits of placing a freeze on your credit reports.

1. Stops New Lines Of Credit From Being Activated

Any fraudster trying to activate a new credit line will be blocked. Credit freezing will additionally prevent lenders from accessing your credit files to check if you’re a good credit risk and whether you are likely to pay off the debt or not.

2. Protects You From Various Identity Frauds

Identity thieves are unable to open new credit accounts using your name once a credit freeze has been placed. However, frauds may still be able to exploit your current running accounts if they are able to access them.

3. Does Not Impact Your Credit Score

Although other factors may shift your score, a credit freeze does not in any way have an impact on your credit score. For instance, on-time payments, and the amount owed in debt may result in a score drop or increase.

4. Free Of Charge

Unlike before, you are no longer required to pay for a credit freeze or unfreeze.

Credit Freeze Disadvantages

Below are some disadvantages of allocating a freeze on credit files.

1. Contact Major Credit Bureaus

The three major credit bureaus must be contacted to allocate or lift a credit freeze, and this demands effort.

2. You Are Required To Keep A Tab On Your PINs

A pin provided to you is required for when you want to freeze or lift the freeze off of your credit reports. Additional steps will need to be taken to get a new one if you’ve lost the PIN that was initially given to you.

3. The Freeze Will Need To Be Lifted For Creditor Access

Lenders need to have a look at your credit report to view if you are a good credit risk. For this reason, a credit freeze must be lifted when you are applying for new lines of credit as your files are analyzed and reviewed to qualify you for a debt.

4. Identity Thieves May Still Be Able To Access Existing Accounts

Identity thieves are unable to open new credit accounts using your name if a credit freeze has been placed. However, they will still be able to exploit your existing accounts by making transactions with your credit card.

Bottom Line: Credit Freeze vs. Fraud Alert

Another option to freeze your credit is placing a fraud alert on your credit profile. This protects your credit history against unlicensed access for twelve months, or up to seven years, depending on whether it’s an extended fraud alert.

Extended fraud alerts are set up after an identity theft report has been created after which a fraud alert needs to be placed with one of the three credit bureaus. The information must be shared with the other two agencies by the bureau you report to.

As with credit freeze, placing a fraud alert or an extended one does not fasten your credit files completely. However, creditors are required to take the extra step of confirming and validating your specifications before approving new lines of credit. Hence, fraud alerts may appeal to people as an easy and effortless solution in comparison to going through the trouble of freezing and unfreezing your credit reports.