Mercury MasterCard Review

Introduced in 2018, the Mercury MasterCard is the most fitting option for those looking for a basic and easy-to-apply credit card as there are no annual fee charges and it comes with a handy mobile application.

The Mercury MasterCard is a good option for those looking to build their credit scores and is marketed towards those with scores varying from 575 – 675.

Mercury MasterCard Stats

Mercury MasterCard has numerous benefits. The following should be kept in mind before applying for this card:

• The Annual Percentage Rate (APR) varies from 25.90% to 27.90%. This can change depending on the Prime Rate.

• 27.90% – 29.90% is the APR for a cash advance and this also shifts based on the Prime Rate.

• No annual fee.

• The late fee is up to $38.

• The balance transfer fee is $5 or 4% from the balance transferred, whichever figure amounts to more.

• The cash advance fee amounts to $10 or 5% of the cash – whichever is more.

• 3% of each purchase will be charged as a Foreign Transaction Fee if your card is used overseas.

• Generally, the credit limit is $1,500 but some users reported being given up to $5,000 in credit as an automatic increase in credit limit.

Benefits & downsides of the Mercury MasterCard

The Mercury MasterCard comes with numerous benefits but there remain a few drawbacks.

Is Mercury MasterCard the right choice for you?

Following are the reasons that make the Mercury MasterCard a solid choice for those with a decent credit score.

1. Convenient Mobile App

The user-friendly app is available on both, the Apple App Store and Google Play Store. Users can check their balance, pay bills, stay updated on their FICO® score, monitor transactions as well as make purchases.

2. Access Your FICO® Score For Free

You can view your FICO® score whenever you will with the ease of the Mercury mobile app.

It’s a great tool if you want to repair your credit score as a majority of the lenders use the FICO scoring model.

3. No Annual Fee

No annual fee is charged with the Mercury MasterCard hence making it beneficial for people who want to increase their credit utilization.

4. Free Fraud Protection

Free fraud liability insurance is provided to Mercury MasterCard cardholders. The user does not have to pay anything if their stolen card is used for unauthorized transactions.

5. Accepted by Merchants Worldwide

Similar to the Visa credit card, the Mercury MasterCard is accepted by merchants globally.

Is Opting For Mercury MasterCard A Sound Decision?

Despite its benefits, the Mercury credit card has a few drawbacks.

1. High Rate of Interest

The Mercury MasterCard has a high rate of interest rate compared to other credit cards.

The average APR for credit cards in the United States varies from 16.53% to 23.68%. The APR for Mercury credit cards ranges between 25.90% to 27.90% and may change with the Prime Rate.

2. High Foreign Transaction Fee

3% of each purchase amount will be charged as a Foreign Transaction Fee if your card is used to make purchases overseas hence making the Mercury MasterCard a poor option to use while traveling.

3. High Balance Transfer Fee

Mercury MasterCard is not the best go-to option if you want to transfer some balance to another card as all transfers come with a fee of $5 or 4% of the balance transferred.

Furthermore, perks such as 0% APR and year-long interest-free periods are not offered with the Mercury credit card.

4. Vague Terms and Conditions

Mercury MasterCard’s terms and conditions are not clearly stated therefore critical information is not made available such as the eligibility criteria.

It should be kept in mind that every card application accounts for a hard inquiry on your credit report so it’s better to get a complete picture of the terms and conditions before deciding what credit card best suits you.

Eligibility Criteria

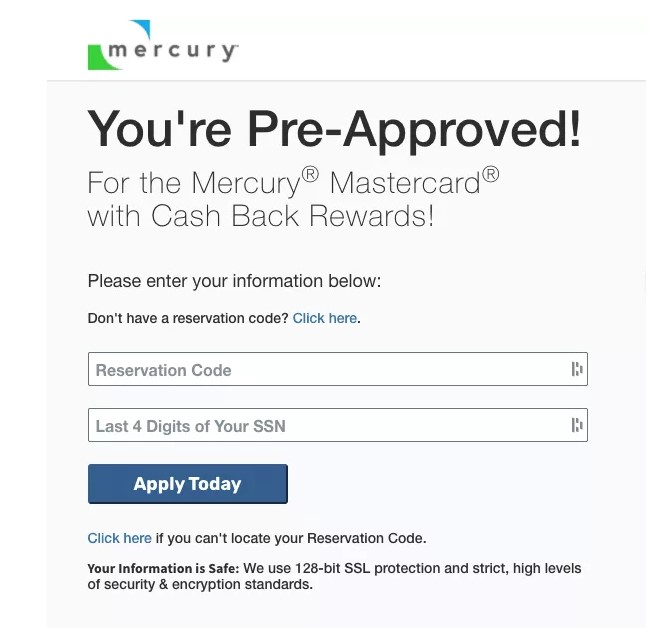

You must receive a pre-approval letter from Mercury to be eligible to apply for the credit card. This ‘invitation only’ application process is what sets Mercury MasterCard apart from the other ones.

Your credit score must be above 575 and under 675 to receive a prescreened offer as the Mercury MasterCard is marketed for those with credit scores in the aforementioned range.

How to Apply for a Mercury MasterCard

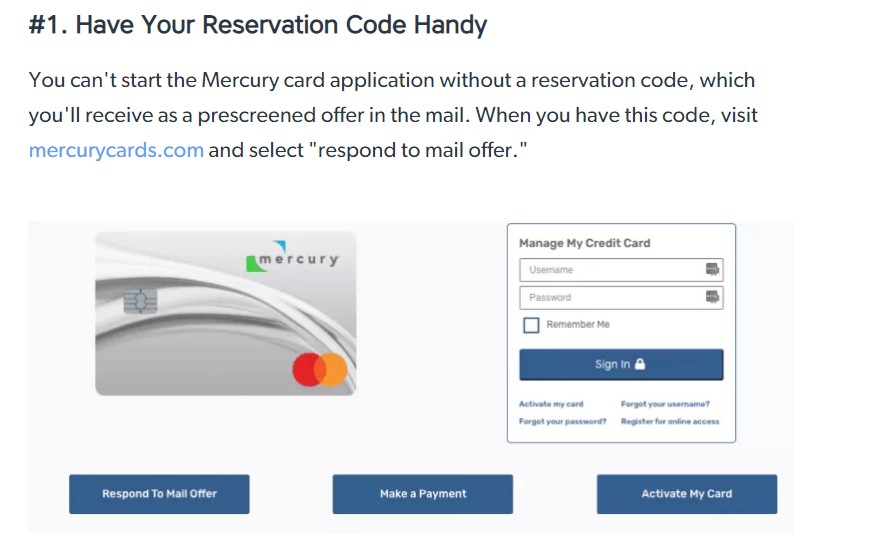

A ‘reservation code’ from Mercury is required to get started with the application process.

1. Reservation Code

Once the ‘reservation code’ is received, go to mercurycards.com and click on the ‘respond to mail offer’.

2. Enter the Reservation Code

After being approved, enter your reservation code along with the last 4 digits of your social security number.

3. Fill out the Application

After verification, you’ll move to the online credit card application where basic identifying information and financial information are required.

You should bear in mind that certain financial documentation might be asked for such as proof of income. Copies of the documents can be scanned or sent via email.

4. Wait for a Decision

It typically takes 4-5 days for Mercury to get back to applicants.

Once your application is approved, you will receive your card via email.

Rewards and Cash Back

Applicants rely on cardholder reviews to get a little insight into the kind of rewards offered because Mercury MasterCard does not provide information regarding this online.

One review on myFICO forums stated that a prescreened offer was sent to the applicant with unlimited 2% cashback on purchases.

Another review stated receiving 1% cashback, and $10 for 1,000 points earned each time.

As is the case with a credit limit, cashback offers and other rewards are seemingly customized for individual cardholders.

Can Mercury MasterCard Credit Limit be increased?

The credit limit for Mercury MasterCard cardholders is $1,500 but some users reported being given up to $5,000 in credit as an automatic increase in credit limit.

The process or criteria for giving cardholders an automatic update for their credit limit is however unclear.

Mercury’s Mobile App?

Mercury’s user-friendly app is available on both, the Apple App Store and Google Play Store. Users can do the following on the app:

• Check account

• Get account information

• Review transaction details

• View FICO® score

• Pay bill

• Get paperless statements

Mercury MasterCard Reviews

All in all, satisfied users reviewed the Mercury MasterCard as a trouble-free method of building your credit score.

A user at Credit Karma reportedly received a $2,000 credit limit without hassle.

Another user stated receiving an automatic increase in credit limit from $1,800 – $4,500.

A five-star reviewer claimed a 130 points improvement in their credit score over one year of using the Mercury credit card.

With the switch of Barclays to Mercury, a disappointed reviewer observed a decrease in their credit limit from $4,000 to $3,000. On the contrary, another user received an automatic credit limit increase from $1,500 to $3,750.

Is Mercury MasterCard The Right Choice?

As per various reviews from different forums, the Mercury MasterCard is rated to be a solid choice if a user needs a backup credit card to increase the credit limit and improve credit utilization.

Alternatives for Mercury MasterCard

A high annual percentage rate of the Mercury MasterCard may make some people hesitant in registering for it.

You may want to consider other options if your credit score is in the lower range, and you are looking to increase it

1. Capital One Platinum Credit Card

The Capital One Platinum Credit Card has no annual fee and offers an increase in credit limit after five timely payments are made.

2. Merrick Bank Double Your Line™ Visa

This credit card allows you to double your available credit after seven months of timely payments.

3. Capital One Quicksilver One Cash Rewards Credit Card

Users get unlimited 1.5% cashback on purchases made. However, it is not without its drawback. The annual fee for the Capital One Quicksilver One card is $39 and users are eligible for a credit limit increase after 5 months of timely payments.

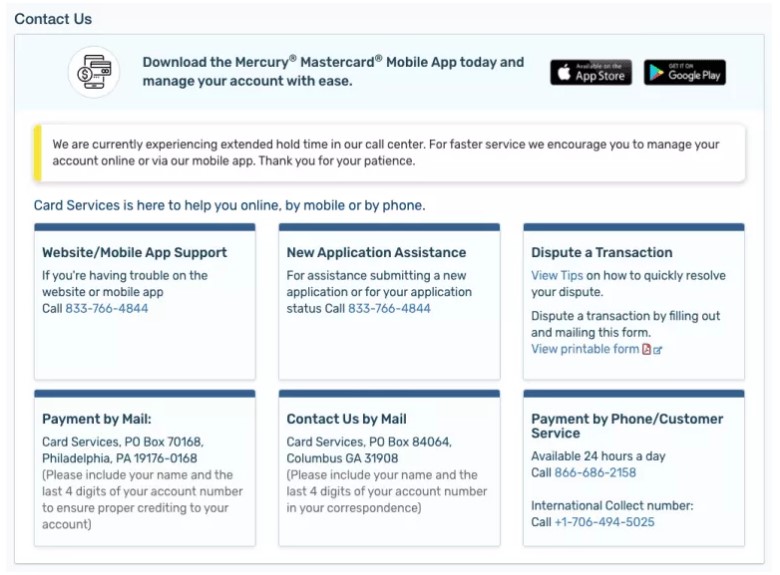

Contact Information: How to Reach Mercury by Phone and Mail