What is a good credit score?

Credit scores vary between 300 to 850, and a good credit score falls in 700 and above. A score of 800 or above in the same range is considered outstanding.

These scores are a numerical estimate and representation of how likely a person is to pay off debts like mortgages, loans, credit cards, and rent and utilities.

Lending institutions utilize credit scores to assess whether individuals qualify for a loan, credit limit, and interest rate. A high credit score indicates that a debtor is at a lower risk and is expected to make payments on time. However, lenders may also have their factors in defining a good or bad credit score.

Creditors also take into consideration the current events which could have an effect on their credit rating and regulate their demands accordingly.

Most credit scores fall in the range of 600 – 750. The average FICO score in the US in 2020 got as far as 710 points, showing an increase of 7 numbers compared to the past year.

The two most common credit-scoring models used by lenders are those created by FICO and VantageScore.

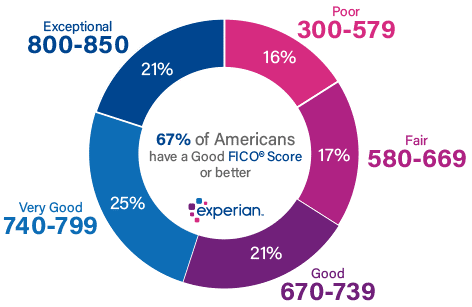

What Makes a Good FICO® Score?

FICO has various types of credit scores for consumers. The company has “base” FICO scores for issuers across numerous industries and sector-wide scores for credit card companies and car loan lenders.

A “good” range for base FICO scores is defined between 670 – 739, with the base range varying from 300 – 850. The base industry-specific FICO credit scores range from 250 to 900.

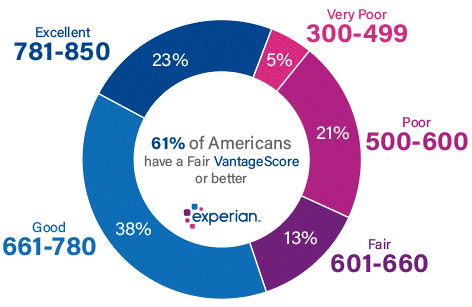

What Makes a Good VantageScore?

The first two credit scoring models for VantageScore range from 501 to 990, whereas the latest VantageScore models (3.0 & 4.0) range between 300 to 800. A “good” range for the newest models is 661 – 780.

What Factors Affect Credit Score?

Frequent factors affecting your credit score are listed below:

● Timely payments: Making payments on time helps with your credit score, but failing to do so can result in a poor score as you may be declared bankrupt or your account may be sent to collections.

● Credit utilization: Factors such as account balance, the amount owed, and your credit limit play an important part in determining how much credit is used.

● Period of credit history: It includes the average period of all your credit accounts, varying from the newest to the oldest accounts.

● Account types: This is frequently known as the “credit mix,” which assesses your management of installment accounts (auto loans, mortgages, and personal loans) and revolving accounts (credit cards).

● Latest activity: Your recent activity is inspected, such as opening new accounts or applying to open a new account.

VantageScore and FICO use different outlooks to explain the importance of the various factors affecting the credit score.

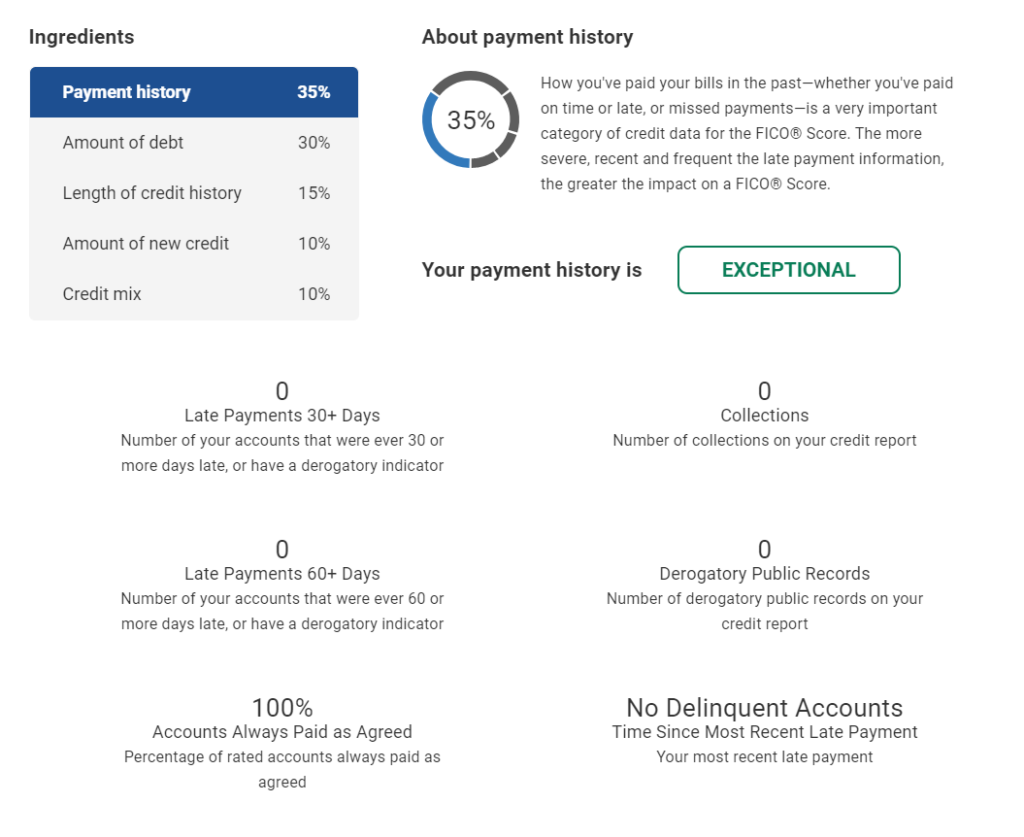

FICO® Score Factors

The FICO scoring model makes use of percentages to depict the importance of each factor in the following order:

● History of payments: 35%

● Amounts borrowed: 30%

● Duration of credit history: 15%

● Credit mix: 10%

● Recent credit: 10%

VantageScore Factors

The VantageScore model categorizes factors by how impactful they may be to your credit score in the following order:

● Complete credit utilization, account balance, and credit at hand: Extremely dominant

● Account types (credit mix): Highly impactful

● History of payment: Somewhat influential

● Credit history age: Less influential

● New accounts and latest activity: Barely influential

Why It Is Important To Have a Good Credit Score

A good credit score can help you achieve your financial and personal goals. It puts a user in good light when requesting a loan such as a mortgage or auto loan. It also impacts the amount you will have to pay in interest or fees.

For instance, a 30-year, fixed-rate $250,000 mortgage with a 670 and 720 FICO score would give you a difference of $72 monthly. This extra amount can be used for savings or attaining other financial goals. Having a good score can save $26,071 of interest payments for you over the loan’s lifetime.

Moreover, credit scores also affect non-lending decisions, like if a landlord agrees to lease you a house or apartment. In addition to that, your credit report also has an impact on you. Employers may have a look at your credit report before recruitment or making any promotion commitment. Insurance companies also use insurance scores based on your credit to determine how much you can pay for car, home, and life insurance services.

How You Can Improve Your Credit Score

Close attention needs to be paid to the fundamental factors which affect your score. Follow these simple steps to improve your credit score:

● Make all basic and debt payments timely. A single delayed payment will lower your credit score, which stays on your credit report for up to seven years.

● Maintain minimum balance on your credit card. The credit utilization rate is an integral factor in determining scores as it compares available balances with the credit limit of credit cards. It is recommended to have your overall utilization rate in single digits.

● Activate accounts that will be reported to credit bureaus and added to your credit report. Installment accounts or revolving accounts such as student, car, housing, personal loan, or credit card can be opened.

● Apply for credit only when needed because opening a new account can lead to hard inquiries, which may pull your credit score low. Applying for different loans or credit cards in a short period also leads to a steep drop in your score.

Additional factors such as improving the average of your account(s) may also increase your score. However, this can only happen over time.

Furthermore, keeping a regular check on your credit score may also give you a good insight into what can be done to better it.

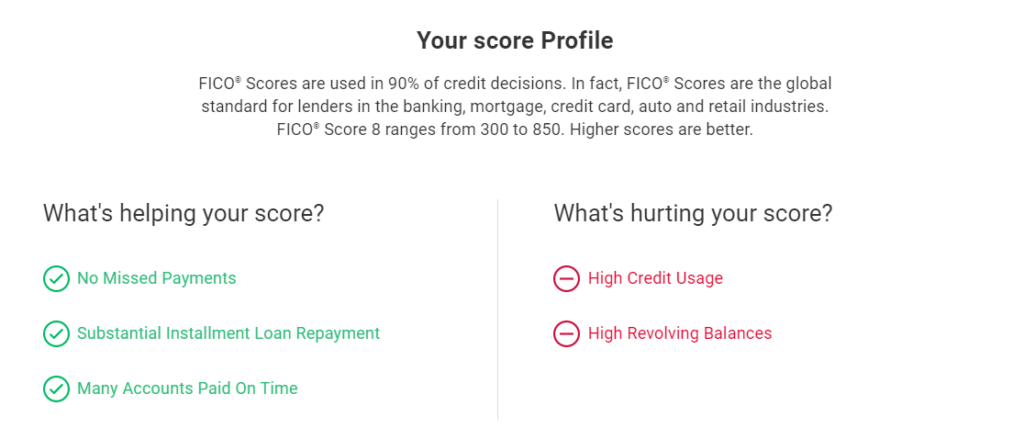

You can check your FICO Score 8 at Experian free of charge.

You’ll get a run-through of your score profile, with a swift review of what helps and hinders your score.

What Can Be Done if You Don’t Have a Credit Score

Credit scoring models use your credit report to determine your score. However, reports with less information can’t be made.

What you need for FICO Scores:

● An account that exists for at least six months

● An account that has been in use for the last six months

VantageScore makes your credit report even with a single active account just a month old.

Consider opening a new account or adding activity to your credit report to build credit. You may even begin with a credit-builder loan or a secured credit card.

Bottom Line: Build a Good Credit Score

Practice the following good credit habits to build up your score:

● Make timely payments. Your payment history has the biggest impact of all the factors in determining your score. The damage of late payment can stay on your credit report for about seven years.

● Maintain a credit card balance below your credit limit; keep your credit utilization 30% or lower.

● Don’t apply for several credit cards in a short time.

● Keep your credit card accounts active. Keeping older accounts running help with the average age of your accounts. Additionally, shutting down accounts lowers your total credit limit, which drives up your credit utilization rate.

● Check your credit reports regularly and dispute any negative information you think is erroneous.

It is cardinal to take immediate action for building a good credit score as it takes time and cannot happen in a short period.