What are CBCS Collections?

The aggressive third-party debt collection agency, Credit Bureau Collection Services or CBCS Collections, is in Florida, Ohio, Columbus, and Jacksonville.

According to the Fair Debt Collections Practices Act (FDCPA), it is important to know your consumer rights if you are contacted by this debt collection agency regarding past debts. Numerous complaints have been filed against CBCS by consumers claiming infringements of the FDCPA, such as failure to provide debt verification.

A CBCS collections account may show up on your credit report if you owe money to a lender and they have employed somebody to make that collection from you.

How To Remove CBCS Collections From Credit Report

A collection account will linger on your credit report and history for about seven years, lowering your credit score. This happens regardless of whether the amount is paid or not. However, removing a collections account from your credit report before seven years is attainable.

Professional credit repair service companies such as Lexington Law can help you remove any collection account and amend your credit. Hiring such an agency will assist you in disputing errors and erroneous entries negatively listed in your credit report. Negative items such as inquiries, delayed payment, charge-offs, dispossessions and repossessions, bankruptcies, judgments and claims, and tax exemptions will be removed with the help of a professional credit repair company.

Dial Lexington Law to get more information: (800) 220-0084

Credit Bureau Collection Services, Inc. (CBCS)/ Revco Solutions Contact Details:

Address:

CBCS Collections

250 E Broad St Ste 2100

Columbus, OH 43215-3754

Shipping address:

CBCS Collections

PO Box 1810

Columbus, OH 43215

Website: https://revcosolutions.com/

Telephone: (855) 202-0113

Should CBCS Collections Be Paid?

Albeit one of the best approaches to deal with a CBCS collection account is to hire a professional credit repair company to work with you, at times, it is considered best to pay the collection account after ensuring that it’s legitimate.

CBCS Collections and Wage Garnishment

CBCS Collections can sue you or even garnish your wage for not making timely payment. Still, there is nothing to worry about if you work with a reputed law firm like Lexington Law who will assist you with disputing the collection account(s), and most likely eliminate it from your credit report. This will notably increase your credit scores.

Contact Lexington Law for further information and learn how you can be assisted with avoiding a lawsuit and removing negative listings from your credit history.

Wage garnishment is practiced in some states, while in others, it is not. In a state where it is permitted, debt collectors are not allowed to threaten to garnish your wage as it is considered illegal.

For CBCS Collections to make any statement that they will not follow through is also viewed as illegal. For instance, they cannot threaten to foreclose on your home or sue you.

CBCS Collections Objections

Most debt collection companies usually have innumerable charges and accusations filed against them registered with Consumer Financial Protection Bureau (CFBP) and Better Business Bureau (BBB). Most of the complaints reported are incorrect reporting, persecution, frequent debt collection reminders via call, or failing to verify a debt. A complaint should be filed under the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA) if you find yourself in any situations with CBCS, stated above.

Debt Collections & Their Influence on Your Credit

Missing payments over months will automatically result in a poor credit score. With the addition of a collection account on your credit report, your financial potential to be allowed new credit will be further reduced.

Multiple collections for the same account may appear on your credit report due to debt collection agents purchasing and selling delinquent debts from each other.

In such a case, it is necessary to dispute the incorrect information on your account with the three major credit bureaus to get them removed or bear the consequences of your credit score being harmed and affected.

Be Aware of Your Rights When Dealing With CBCS Collections

Strict ordinances exist in the United States regarding the dos and don’ts of a debt collector.

The Fair Debt Collection Practices Act prohibits using abusive or deceiving strategies to collect debts. Additionally, the act grants you the right to guarantee that debt collection agencies do not take advantage of your situation. To highlight a few:

- For CBCS Collections to list incorrect or wrong information on your credit report is to go against federal law.

- As per the Fair Debt Collection Practices Act, you are right to validate alleged debts by sending a debt validation letter to CBCS Collections. By law, the collection agency has 30 days to make the necessary calculations and give proof that the debt is yours, providing the total accurate amount.

- CBCS Collections does not possess the right to pressurize, threaten, harass you, or publicly publish a list of debtors.

- The collection agency should practice transparent transactions, clearly stating what they do.

- CBCS Collections cannot threaten to file a lawsuit against you or arrest you if they do not intend on doing so.

Additional Tips on Dealing with CBCS Collections

- Conversing with a debt collector over the phone should be avoided. It is recommended to have everything written before dealing with any collection agency, preferably via an official letter with the original debt information. A cease and desist letter should be sent to the agency in case of persistent harassing calls.

- Record phone calls with debt collectors if you have to deal with a collection agency over the phone. The District of Columbia and thirty-five other states permit you to record phone calls secretly.

- Don’t be gullible and trust all information being given to you. Debt collection agencies are well known for lies and erroneous threats to get you to pay off the debt.

- Don’t give them access to your bank account details or your credit card information. However, money should not be hidden from legit debt collectors, especially when you owe them, as it would be considered illegal.

- New lines of credit should not be applied for if you cannot pay your current balance as it is fraudulent and deceitful.

- Don’t completely avoid CBCS Collections, as it can set you up for possible legal action being taken against you.

- Be familiar with your state’s enactment of limitations. In some states, a debt is considered a “zombie debt” when it reaches a certain age, customarily 4-6 years.

Once it has reached this stage, you are not legally obliged to pay it off. However, there is no limitation on whether a collection agency can contact you regarding these debts.

Validate and Verify the Debt

A debt validation letter may be sent to CBCS Collections if you think the company is mistakenly trying to collect payment from you. You may also want to send a cease and desist letter to the agency or register a complaint against them with the FTC or your state’s chief law officer.

Under the Fair Debt Collection Practices Act, you are right to validate alleged debts by sending a debt validation letter to the collection agency. By law, CBCS Collections will have 30 days to calculate and prove that the debt is yours, providing the total accurate amount.

Reach An Agreement

After CBCS proves to you that your debt is legitimate, try to make some adjustments to the amount before paying them the debt.

Try to get them to settle the account at a lower payment and remove any derogatory marks on your credit report that have already been disputed with credit bureaus. Ensure to have everything in writing before moving forward with the procedure.

Takeaway: Eliminate CBCS From Your Credit Report Today!

If you’re searching for a well-reputed credit repair company, Lexington Law is highly recommended to help you deal with and get rid of collection accounts on your credit report. With over 18 years of expertise in the field, the law firm has helped remove more than seven million erroneous credit report entries for clients in 2020.

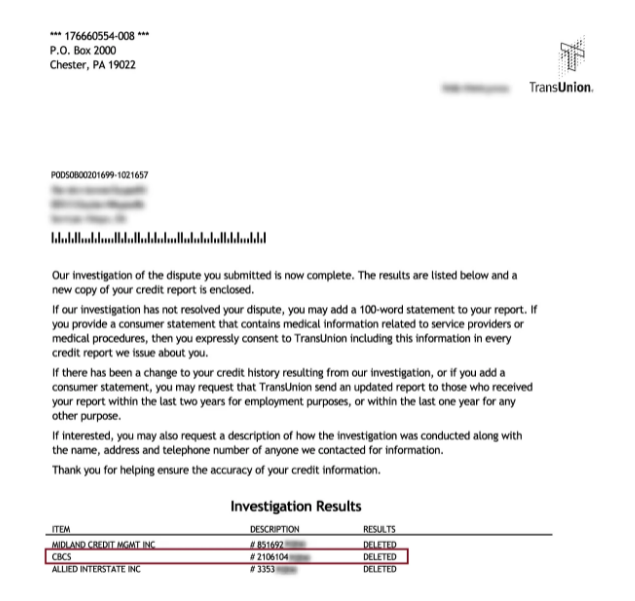

Proof of Collections being removed:ong>

Contact Lexington Law at (800) 220-0084 for free expert consultation regarding your credit issues.

They will assist you with deleting all kinds of negative entries in your report, including collection agencies such as CBCS Collections.