The Lexington Law: Best Detailed Review For Credit Repair

Have you ever looked into credit repair agencies? If yes, you must have come across Lexington Law. Since its establishment in 2004, the firm has assisted in the removal of approximately 56 million negative entries, making it one of the largest credit repair services in the country.

Although, the firm has lately come under fire after it became the object of federal action, with a complaint alleging that the firm participated in fraudulent activities.

We conducted an in-depth examination of the company’s services, price, conditions, and credibility to determine what this implies for clients considering signing up with Lexington Law.

Is Lexington Law one of the top credit repair services, or are there other options? In this Lexington Law review, we’ll provide you with all you need to know about the firm so you can determine if it’s a good fit for you.

What is Lexington Law?

Lexington Law started providing credit restoration services in 1991. It is a real legal firm that functions under the name John C. Heath, Attorney at Law, PLLC.

Lexington Law now services clients in states ranging from New Mexico to New Jersey and beyond. They currently do not service Idaho or North Carolina.

While Lexington Law specializes in credit restoration, the business also offers other assistance such as identity theft protection and personal finance tools.

Numerous credit repair firms have begun and died in the last 25 years, but Lexington Law has remained a credit repair industry mainstay. However, stability does not always come with the finest reputation.

Lexington Law Firm has a ‘C-‘ rating from the Better Business Bureau (BBB), with over 700 complaints made in the previous three years. Criticism includes making false promises on credit score increases, failing to deliver on promises, and overpricing for services.

Table of Contents

How Does Lexington Law Work?

Lexington Law’s credit repair procedure is negotiating with credit agencies on your behalf to refute incorrect information on your credit report. Since this Fair Credit Reporting Act requires credit agencies to record only verified and reliable information, any items that do not fulfill these requirements must be removed.

Lexington Law works with your creditors to resolve easy adjustments, errors, and missing information after reviewing all of your credit report information.

After the deletion or elimination of such inaccurate and false information, your credit score would eventually increase. Lexington Law does follow a legal procedure. But it is obviously not a debt-relief enchantment; it won’t create magic or wonders for you.

This association would give you plenty of information that might help you monitor your credit history and maintain a strong credit score in the future – So, so you will receive financial literacy as well.

Types of Negative Items Lexington Law Helps With

Lexington Law’s website shows that the company’s current customers had over 1.5 million items removed from their credit reports in 2019. These items were either false or misleading:

- Bankruptcies

- Repossessions

- Foreclosures

- Collections

- Late payments

- Charge-offs

- Judgments

What Makes Lexington Law Firm Different?

Lexington Law’s credit repair instructional resources are among the best available in the business. They also deal with harassing messages from collection agencies and creditors, which is a basic service that is provided by the majority of credit restoration organizations.

Customers are attracted to the credibility that comes with your credit repair company as a professional law practice, whether perceived or actual.

Types of Services and Their Costs:

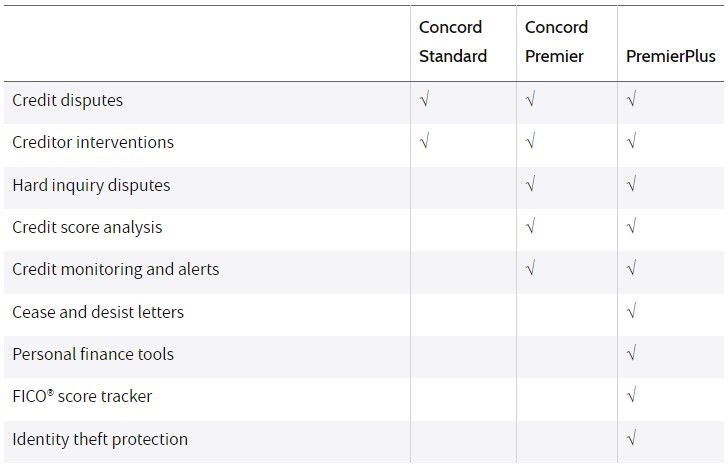

Lexington Law offers three services, ranging from basic credit restoration to more expensive solutions. Customers only pay for the services they acquire. Those with relatively simple needs can select a less expensive option, while those with more complicated demands can purchase more in-depth support.

Concord Standard

The Concord Standard plan includes two service options — creditor interventions and creditor disputes. During the credit negotiation phase, Lexington Law will detect inaccuracies in your credit report and propose that those items be deleted from the credit agencies. Creditor interventions are several sorts of interactions that the firm might send directly to lenders and collection agencies on your account.

Lexington Law’s standard plan, which costs $89.85 per month, includes all of the credit restoration services that the majority of individuals require. Lexington Law will work on your behalf and submit challenges and interventions to the bureau.

Concord Premier

The mid-tier plan of Concord Premiere contains the credit restoration fundamentals provided by the Concord Standard plan as well as a few other services. Lexington Law will challenge any inaccurate query on your report that should not be there with this package.

Upgrading to the Concord Premier plan gives you access to InquiryAssist, Score Analysis, ReportWatch, and Credit Alerts. These solutions will assist you in monitoring your credit reports and understanding your credit score. You may as well receive a credit score analysis and regular credit monitoring, as well as alerts when your credit score changes.

For $109.95 per month, the Concord Premier plan includes monthly assessments and continuous monitoring services.

Premiere Plus Service

Lexington Law’s Premier Plus package includes not just credit repair but also added financial assistance that may be beneficial. This package, which builds on the lower-level plans, also comprises cease-and-desist letters, which the corporation may send to creditors to stop collection activities such as harassing phone calls.

This is the most comprehensive Lexington Law package. It costs $129.95 per month including all of the tools you could possibly need for credit restoration and more. Premier Plus may be the service level for you if you want further assistance with budgeting.

What To Expect After You Sign Up With Lexington Law

Once you sign up with Lexington Law, you will get your credit reports digitally at your stated email address, as well as a printed copy.

Let’s take a look at the Lexington Law credit restoration process, shall we?

A credit advisor will call you and identify themselves as your personal representative within 48 hours of signing up at Lexington Law. Your credit counselor will request information from you in order to examine your reports and identify the best course of action.

Your agent will call you after reviewing your complete credit analysis to monitor and discuss each issue they wish to dispute. In this stage, experts initiate the process of eliminating false information from your credit report by sending the necessary paperwork to creditors and credit reporting bureaus. Based on your scenario, the processing time may vary.

If you have one of the Premier plans, you will receive a credit score analysis after the issues are rectified. Your agent will maintain contact in case of any unresolved concerns and raise them until an acceptable resolution is obtained.

If you are dissatisfied with your outcomes from Lexington Law, you can terminate your suit at any moment: on the internet, over the call, or by email.

Is Lexington Law Worth Your Money?

If you want to improve your credit score, Lexington Law is one of the most proactive credit repair firms to engage with. As you can see, it is a real law practicing agency with lawyers and professionals that have the industry understanding to assist you to work through a rat’s nest of a credit issue.

Lexington Law is certainly not a quick fix. A credit repair business might take several months, if not years, to demonstrate results, however, some customers may see improved credit reports much quicker. Just relax and keep in mind that what you are doing is a step on the right path.