3 Best Guaranteed Approval Credit Cards For Bad Credit

Do you have bad credit? And you’re looking for credit cards for bad credit? Do not lose hope. While your credit card choices might get somewhat limited, there are still several available for you to pick from. Credit cards for bad credit are often easy to apply for and may be used to assist you in rebuilding your credit.

The best credit cards for bad credit are ones with decent rates and safety deposit minimums (for secured cards). You should also seek a credit card that would assist you in building your credit by submitting your payments to credit agencies. Furthermore, you may seek credit cards that include a reward system. Even though this isn’t the most vital characteristic to seek for in a credit card for bad credit, you may as well get some points, right?

Table of Contents

What is Bad Credit?

In most cases, bad credit is characterized in terms of a person’s credit score. The FICO score is the most often utilized credit score. FICO ratings vary from 300 to 850. Anything with a credit score of 579 or below is considered bad credit.

580 to 669 is considered fair credit. Failing to pay your payments timely or defaulting on a loan are common causes of bad credit. Bad credit might make it even more challenging to acquire a credit card or a loan.

Causes of Bad Credit

Numerous reasons can contribute to bad credit, such as:

- Maxing out your credit cards

- Late bill payment

- Foreclosure of your home

- Filing for bankruptcy

- Missed payments

- Defaulting on a loan

- Having account go to collections

3 Best Credit Cards For Bad Credits — Guaranteed Approval

We realize that having 10 credit cards per year is doable, but we don’t think it’s a smart idea. If you’re going to do it, you may as well get the finest credit cards for bad credit. So, we are going to tell you about the top 5 most valued credit cards that don’t require a credit check.

- OpenSky — Best Credit Card for Bad Credit Overall

- Surge Mastercard — Great for Small Business

- First Access — Best To Build Credit

- FIT Mastercard — Credit Cards For Bad Credit

- Reflex Mastercard — Secured Credit Card

1. OpenSky — Best Credit Card for Bad Credit

If you want to improve your credit, you might be wondering if a secure card might help. A credit card, such as the OpenSky Secured Visa, allows us to build credit while maintaining the security of a reimbursable deposit.

Capital Bank offers the OpenSky credit card. Because of the secured nature of the credit card, customers are required to pay a specific amount of money as protection in the event of a loan default.

This card costs an annual fee, unlike most other secured cards from significant issuers, and it also does not provide an unprotected account upgrading option.

The highlight of this credit card it:

- No Credit Check — If your credit score is in the bad to medium level, you may be eligible for this credit card.

- Credit Bureau Reporting — You can be confident that your payments will be recorded to all major credit bureaus if you have this card.

- Make Your Credit Limit — Rather than a credit check, the bank will charge a fee a one-time charge as collateral, and the collateral you pay will become your credit limit.

- APR and Fees — The OpenSky card has a somewhat higher annual charge of $35, as opposed to many secured cards, which have no annual fee. To compensate for the disadvantage, you will have to pay a reduced variable APR of 17.39 percent, which is lower than the APR on other secured cards.

2. Surge Mastercard – Great for Small Business

Surge Mastercard is designed for people who desire to enhance their credit history via prudent credit card use. Celtic Bank’s Surge Mastercard is a credit card designed to help you repair your credit. Despite the lack of notable benefits, you may use this credit card to enhance both your spending power and credit score.

Unlike many other cards for those with bad credit, this one does not need a security deposit when you start an account. This is why this card is a secure choice, as there is no risk as collateral.

The highlight of this credit card it:

- $0 Fraud Liability — The Surge Mastercard has a $0 fraud liability, which makes it one of the best credit cards for preventing identity theft. This indicates that you are safe from illegitimate transactions and you will not be invoiced for them.

- Card Fees — You will most likely be charged an APR ranging from 24.99 percent to 29.99 percent. As a result, Surge Mastercard is ideal for people who can afford high yearly fees. Unfortunately, you will be charged an annual fee of $75 to $99 for the first year you hold this card.

- Chances of Credit Limit Increment — If you apply for the Surge Mastercard, your initial credit limit will range from $300 to $1,000. After six months, the credit limit on the card can be increased, thus improving your credit score. You will, though, need to apply to increase your credit limit.

- Pre-Qualification — Surge Mastercard pre-qualifies you for credit, allowing you to begin the registration process before having to submit any payment or personal information.

3. First Access – Best To Build Credit

The Bank of Missouri First Access Visa Credit Card is designed to help you develop or restore your credit. According to the bank, this will allow you to return to the core of credit products with more alternatives and services. In contrast, an unsecured credit card with a line of credit (usually set at roughly $300) does not have this restriction.

The highlight of this credit card it:

- Card Acceptance — All of your day-to-day transactions are made easier with the First Access Visa Credit Card. This credit card can also be used to pay bills like shopping, movies, and even dine-outs.

- Secure Application — The First Access Visa Card claims to provide all you need to effortlessly apply for a credit card. Aside from the app’s minimalism, their website is also secure, safeguarding your sensitive information.

- Card Design — Whatever sort of card you are searching for, First Access Visa has it. It offers various styles and colors of cards to pick from, your new card may be as one-of-a-kind as you are.

- Charges and Limit Increase — This card comes with a few fees, including a hefty one-time initiation charge. Also, there is an annual fee that is significantly greater than that of comparable goods, which is ideal for people looking for a card that is simpler to qualify for. You can ask for a credit limit increase in your second year. They charge a monthly servicing fee along with yearly charges. You also don’t get cashback or other benefits like special travel privileges or room service.

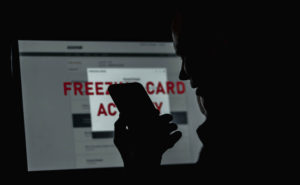

Credit cards are one of the most convenient methods to access money, but not everyone is eligible to have one issued in their name. People with less-than-perfect credit ratings or histories may have difficulty obtaining a card.

If you fall into this category, you may want to consider the credit cards mentioned above to help you establish positive credit.

Applying for a credit card with negative credit is doable, and it may be surprisingly simple. Our reviews should help you make your selection, and we’ve also included a few pointers for individuals who are applying for a card for the very first time.